B2B payments built by the experts

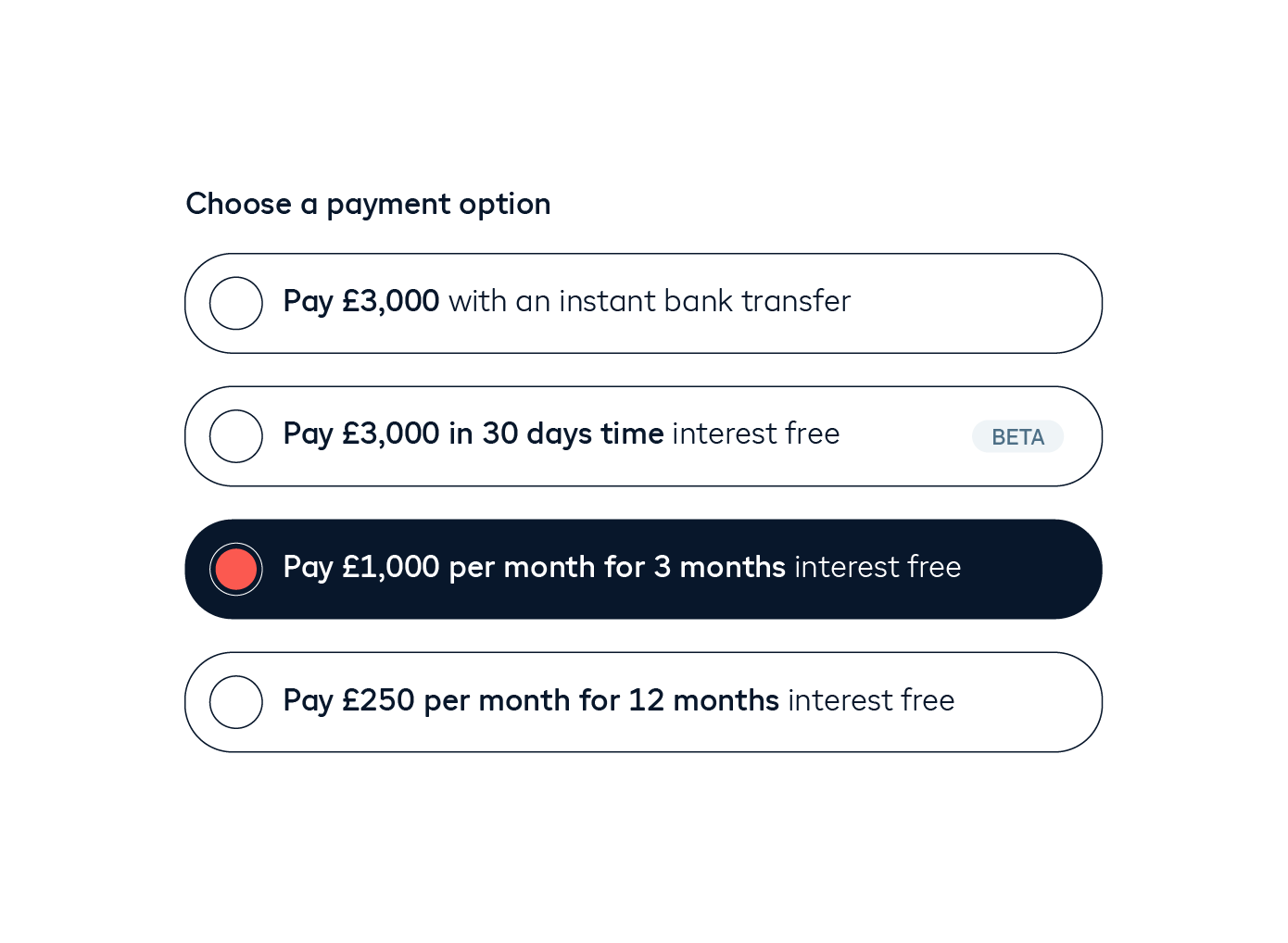

Offer approved trade customers flexible payment options and spending limits up to £30,000.

- Get the funds instantly, every time

- Accept payments online and in-person, without fees

- Outsource manual processes and credit risk

60%

increase in

conversion rate

45%

increase in

average order value

based on results from iwocaPay suppliers

60%

increase in

repeat purchase rate

.webp)

.svg)

%20(1).svg)

iwocaPay FAQs

There are a lot of things to think about when it comes to Buy Now Pay Later for trade customers. Here are some of the common questions we get asked.

Does iwocaPay credit check my customers?

We don’t do any credit checks for customers using Pay Now, but business customers using Buy Now Pay Later will need to get approved before they can spread the cost with iwocaPay. We only run soft credit checks which means applying won’t affect your credit score.

iwocaPay is part of iwoca - an award winning small business lender that’s made finance available to more than 90,000 businesses.. iwocaPay uses the same proprietary credit checking software to make sure we’re supporting as many businesses as possible while being a responsible lender.

How can iwocaPay offer free payments?

We don’t believe businesses should pay to access their money - that’s why we only charge when we add a service, rather than just moving funds from A to B.

That means Pay Now is always free for you and your customers. It’s powered by Faster Payments and Open Banking to allow your customer to securely send you money from their bank account to yours instantly.

We only charge for Pay Later when your customers use it , there’s no subsctiption fees. You also control who pays for Pay Later - either a fixed % on each Pay Later transaction for you (and interest free for your customers) or free for you and interest bearing for you customers.

What happens if my customers don’t pay iwocaPay?

We take on all the credit risk so there’s no recourse - that means if your customers don’t pay us we’ll never come to you asking for the money (unlike other solutions like invoice factoring).

We also don’t outsource our credit recovery process to nasty third parties. iwocaPay is part of iwoca - an award winning small business lender with years of experience lending responsibly and working with businesses to get them back on track when they struggle to pay.